Cyberattacks are increasing rapidly, and the financial toll is massive. According to IBM, the average data breach cost in 2024 was $4.88 million, up 10% from 2023.

Cyber insurance helps businesses navigate these growing risks by providing financial protection against cyber incidents. To maximize the value of your coverage, you need to understand cyber insurance costs.

Whawenst Duvet, CTO of OneTech360, emphasized, “Technology-dependent businesses need cyber insurance now, more than ever, to mitigate financial risks.”

Let’s explore why cyber insurance matters and how it can protect your business.

Ready to Optimize Your Cyber Insurance Coverage?

Let OneTech360 guide you in finding the perfect policy to protect your business at the right cost.

Why Cyber Insurance Matters for Your Business

Cyber insurance offers more than just financial coverage. It’s your company’s safety net. If your business faces a cyberattack or data breach, cyber insurance covers a wide range of expenses, from legal fees to data recovery and even compensation for affected clients.

With threats like phishing, ransomware, and data breaches on the rise, having a policy in place allows you to continue your operations confidently.

Key Factors Affecting Cyber Insurance Costs

Several factors determine the cost of cyber insurance, from your industry’s risk profile to the strength of your cybersecurity measures. Here’s what you need to know to secure the best coverage for your needs.

1. Business Size and Industry

Certain industries face higher risks, resulting in higher cyber insurance costs. For instance, the financial, healthcare, and legal sectors are prime targets for cybercriminals due to the valuable data they manage. Larger organizations also pay more for cyber insurance simply due to the increased potential impact of a breach.

2. Coverage Type and Extent

The amount and type of coverage affect cyber insurance premiums. Policies range from basic to comprehensive, covering everything from data loss to third-party liability. More extensive policies cost more but offer broader protection, making it essential to weigh your business needs against your budget.

3. Cybersecurity Measures in Place

Businesses with strong cybersecurity measures often receive discounted rates. Insurers reward clients who proactively reduce risks through employee training, multi-factor authentication, and endpoint protection. Investing in these areas can lower your insurance premiums.

4. Claims History and Risk Profile

Your business’s claims history and risk profile affect your insurance cost. Your premiums may increase if you’ve had past claims or security issues. Keeping a strong security record and a low-risk environment can help keep costs down.

Types of Cyber Insurance Coverage and What They Cost

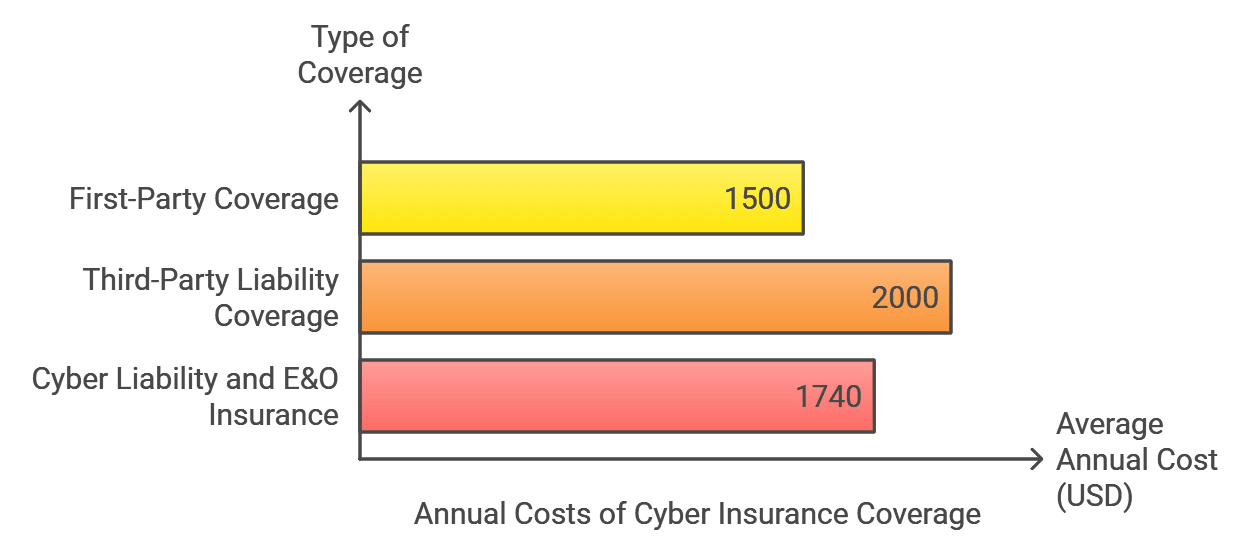

Cyber insurance comes in various forms, each designed to cover different risks. Here’s a look at the main types and what you can expect to pay for each.

First-Party Coverage

First-party coverage handles losses directly suffered by your company, such as data restoration, legal fees, and operational downtime. Costs vary depending on the amount of data managed and your company’s security posture, typically starting at around $1,500 annually.

Third-Party Liability Coverage

Third-party liability coverage protects against lawsuits filed by clients or partners whose data may have been compromised. Rates for this coverage can vary greatly, depending on the type and volume of third-party data you handle, often starting around $2,000 per year.

Cyber Liability and Errors & Omissions (E&O) Insurance

Cyber liability coverage is a more comprehensive plan that can include first-party and third-party protections. Errors and omission insurance, often bundled with cyber liability, covers mistakes that could lead to data breaches. Businesses with significant exposure to client data usually consider these policies essential.

How much does cyber liability insurance cost? Cyber liability insurance typically costs around $145 per month, totalling approximately $1,740 per year.

How to Reduce Your Cyber Insurance Costs Effectively

Lowering your cyber insurance costs doesn’t have to be complex. You can reduce premiums and defend against cyber threats by investing in proactive cybersecurity measures.

1. Invest in Cybersecurity Training and Protocols

A proactive approach to cybersecurity can help you secure lower premiums. According to CloudSecureTech, 25% of employees tend to click most of the links sent to them via email or social networks. Training your employees to identify phishing attempts, implementing multi-factor authentication, and maintaining data backups significantly reduces your risk profile.

2. Review Coverage Options with a Cybersecurity Expert

Consult with a cybersecurity expert to understand which coverages are essential and which might be redundant for your business. This consultation can help you create an effective and cost-efficient policy.

3. Regularly Update Systems and Educate Employees

Insurers often look for updated systems and employee education as indicators of a low-risk business. You can positively influence your cyber insurance premiums by keeping systems up-to-date and ensuring employees are aware of security protocols.

|

More articles you might like: |

Finding the Right Cyber Insurance Policy for Your Business

Consider your business’s specific needs and vulnerabilities when choosing a cyber insurance policy. Look for coverage that aligns with your risk level and covers the types of cyber incidents you’re most likely to face.

Comparison shopping among providers and consulting with experts will also help ensure you get the best value for your investment.

- Assess Your Business Risks: Identify which types of data your business handles and the potential risks.

- Research Providers: Look into providers that specialize in cyber insurance for your industry.

- Consult an Expert: Get advice on a policy that offers full protection without unnecessary costs.

Cost Comparison of Cyber Insurance Policy Types: Which Coverage Impacts Premiums the Most?

Choosing the right type of cyber insurance coverage can impact your premium significantly. The table below outlines common policy types and how each influences overall costs.

|

Policy Type |

Coverage Details |

Cost Impact |

Typical Premium Range |

|

Network Security Liability |

Covers losses from security failures, malware, DDoS attacks, and unauthorized access. |

Moderate to High |

$1,500 – $5,000+ per year |

|

Privacy Liability |

Includes legal fees and settlement costs for breaches affecting personal or customer data. |

High |

$2,000 – $6,000+ per year |

|

Data Breach Response |

Covers costs for notifying customers, credit monitoring, and PR response after a breach. |

Moderate |

$1,200 – $4,500+ per year |

|

Regulatory Defense Coverage |

Addresses fines, penalties, and legal defense costs related to regulatory non-compliance. |

High (especially for regulated industries) |

$3,000 – $7,500+ per year |

|

Business Interruption Coverage |

Compensates for income loss and operational costs during system downtime caused by cyber events |

High |

$3,500 – $10,000+ per year |

|

Media Liability Coverage |

Protects against claims of copyright infringement, defamation, and other media-related risks. |

Moderate to Low |

$1,000 – $3,000+ per year |

Get Expert Guidance on Cyber Insurance Costs and Coverage

Understanding cyber insurance costs allows you to choose coverage that aligns with your business needs. By considering factors like coverage type, security measures, and industry-specific risks, you can select the best policy for effective protection.

Onetech360 is dedicated to guiding businesses through finding the right cyber insurance coverage.

|

Discover Trusted Cybersecurity Services in Manhattan, New York |

Contact us today to discuss your cyber insurance needs and ensure your business has the comprehensive coverage it deserves.